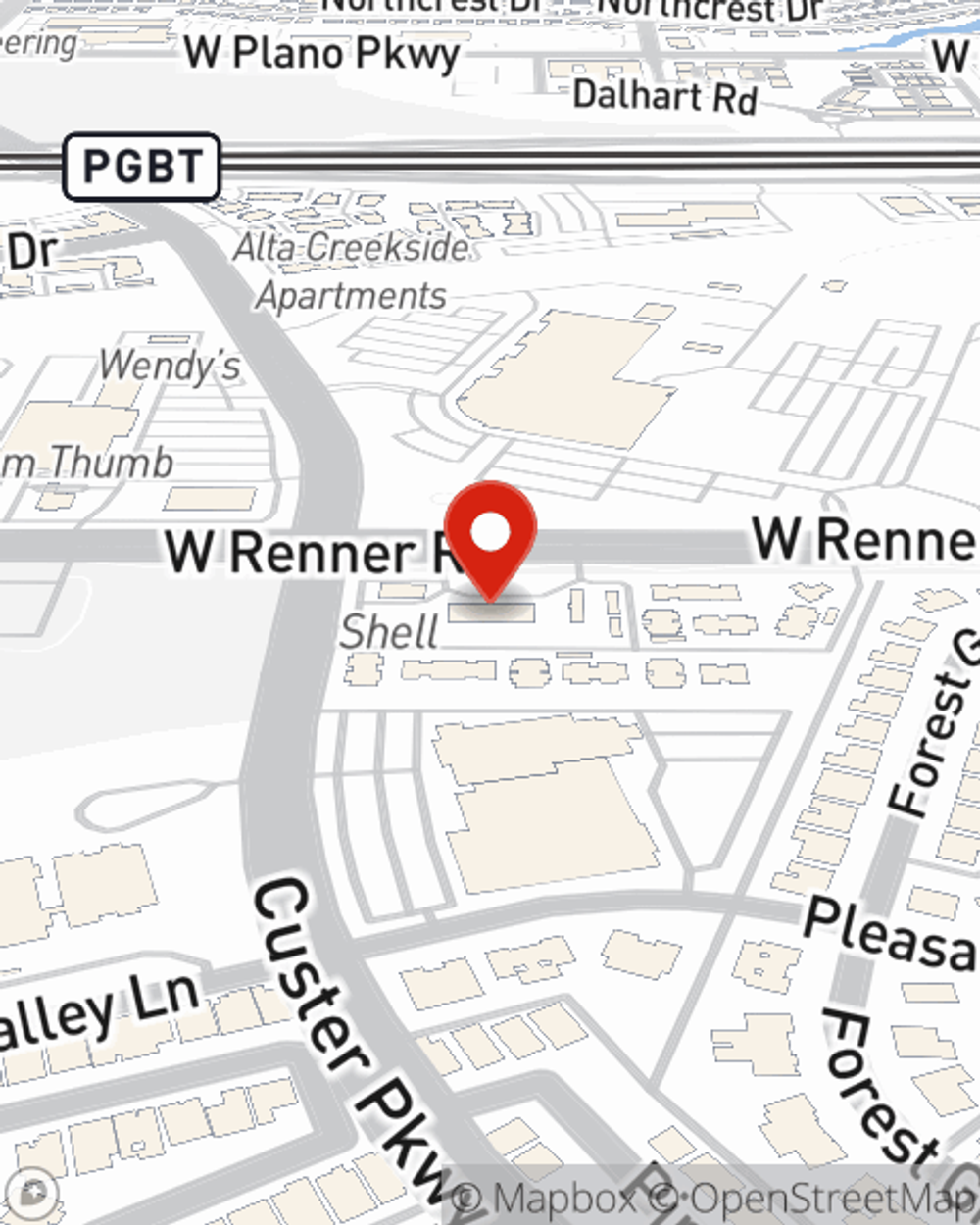

Life Insurance in and around Richardson

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Plano

- Richardson

- Dallas

- Garland

- Carrollton

- Irving

- Farmers Branch

- Addison

- Mesquite

- Rowlett

- Duncanville

- Grand Prairie

- Lewisville

- The Colony

- Frisco

- McKinney

- Allen

- Coppell

- Flower Mound

- Rockwall

- Fort Worth

- Wylie

- Forney

- Seagoville

Be There For Your Loved Ones

One of the greatest ways you can protect your family is by taking the steps to be prepared. As uneasy as thinking about this may make you feel, it's a great idea to make sure you have life insurance to prepare for the unexpected.

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Life Insurance Options To Fit Your Needs

Choosing the right life insurance coverage is made easier when you work with State Farm Agent John Moore. John Moore is the caring associate you need to consider all your life insurance needs. So if you pass, the beneficiary you designate in your policy will help your loved ones or your family with bills and other expenses such as future savings, utility bills and phone bills. And you can rest easy knowing that John Moore can help you submit your claim so the death benefit is presented quickly and properly.

Don’t let the unexpected about your future stress you out. Reach out to State Farm Agent John Moore today and learn more about how you can benefit from State Farm life insurance.

Have More Questions About Life Insurance?

Call John at (972) 234-2900 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.